Money creation

Do you know how money is created?

Anyone who still believes that banks only lend money that they actually own is completely wrong.

The

majority

of

people

are

under

the

misconception

that

the

money

banks

lend

to

borrowers

comes

from

customer

deposits

and

that

if

someone

is

unable

to

repay

their

loan,

the

bank

suffers

a

loss

as

a

result.

This

is

far

from

the

case!

I

would

therefore

like

to

explain

the

process of so-called "bank money creation" using this example:

A

customer,

let's

call

him

Anton,

deposits

100

euros

in

cash

into

his

current

account

at

his

bank.

In

return,

he

receives

100

euros

credited

to his account. The bank calls this balance a "sight deposit".

Anton can now access these 100 euros at any time, either by making a cashless transfer or by withdrawing cash.

As

the

bank

is

clever,

it

doesn't

just

leave

this

deposited

100

euros

lying

around

and

wait

for

Anton

to

withdraw

some

of

it

at

some

point,

but "works" with it.

If

Anton

now

wants

to

make

a

transfer

to

another

customer

of

the

same

bank,

let's

call

him

Bert,

the

bank

doesn't

even

have

to

touch

these

100

euros.

It

only

has

to

deduct

this

amount

from

Anton's

account

in

the

computer

and

add

it

to

Bert's

account.

Over

the

years,

the

bank

has

gained

a

certain

amount

of

experience

as

to

what

percentage

of

its

sight

deposits

is

required

as

a

cash

reserve

in

order

to

be

able

to

cope

with

the

ongoing

withdrawals

and

transfers

to

other

banks.

The

banks

call

this

the

"technical

minimum

reserve".

In

order

to

be "allowed" to "work" with the money, the bank must also deposit the legally prescribed minimum reserve with the central bank.

All in all, this means that the bank has to hold around 3% of its sight deposits in reserve.

It can therefore "work" with the remaining 97%.

Of

the

100

euros

that

Anton

has

paid

in,

she

will

therefore

only

keep

3

euros

as

a

reserve,

the

other

97

euros

are

labelled

by

the

bank

as

"surplus reserve".

Incidentally,

it

is

not

even

legally

clear

to

whom

this

so-called

surplus

reserve

belongs.

And

since

this

is

not

clearly

clarified

by

law,

the

bank considers it legitimate to dispose of this "surplus reserve" completely freely, of course without informing Anton.

The bank may now grant this 97 euros to a borrower as a loan, or it may act as if this 97 euros were the minimum reserve for a new loan.

In

this

way,

she

now

grants

another

customer,

let's

call

him

Christian,

a

loan

totalling

3233.33

euros.

This

means

that

the

3%

reserve,

which she needs, is exactly the 97 euros "surplus reserve" from Anton's paid-in 100 euros.

The bank's balance sheet now shows a liability of 3233.33 euros to Christian, who now wants to dispose of this money.

At

the

same

time,

however,

the

bank

now

has

a

receivable

of

EUR

3233.33

from

Christian,

as

he

has

to

repay

the

amount

with

compound

interest.

On

the

assets

side,

as

well

as

on

the

liabilities

side,

the

bank's

balance

sheet

therefore

shows

an

amount

of

3233.33

euros,

which

can

be

described as a transaction not recognised in profit or loss.

However,

the

bank

will

earn

interest

on

these

3233.33

euros

and,

in

the

event

that

Christian

is

unable

to

repay

his

loan,

the

bank

will

legally

take

away

Christian's

property,

which

he

has

deposited

as

collateral

for

the

loan.

This

is

despite

the

fact

that

the

bank

has

not

suffered any loss, because the money for the loan was not even in the bank's possession.

So

what

happened?

The

bank

received

100

euros

in

cash

from

Anton

and

then

granted

3233.33

euros

as

a

loan

to

Christian,

purely

through

accounting

transactions.

In

this

way,

3133.33

euros

were

"created"

or

rather

"scooped

up"

that

were

not

there

before.

And

although this is not cash, this so-called "bank money" is just as usable in real terms.

A

few

transactions

by

the

bank

have

now

created

money

that

Christian

has

to

pay

back

with

interest

without

the

bank

having

provided

anything in return.

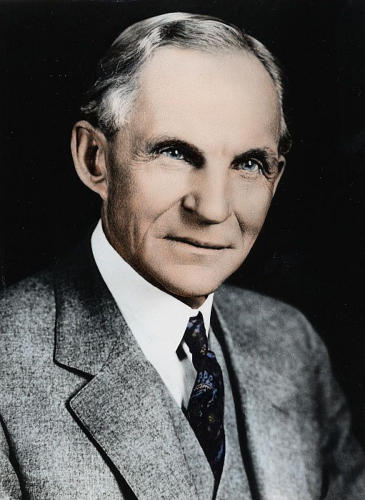

By the way, Henry Ford once said:

If people understood

the monetary system,

we would have a revolution,

before tomorrow morning!

Money creation

Do you know how money is

created?

Anyone

who

still

believes

that

banks

only

lend

money

that

they

actually

own

is

completely wrong.

The

majority

of

people

are

under

the

misconception

that

the

money

banks

lend

to

borrowers

comes

from

customer

deposits

and

that

if

someone

is

unable

to

repay

their

loan,

the

bank

suffers

a

loss

as

a

result.

This

is

far

from

the

case!

I

would

therefore

like

to

explain

the

process

of

so-called

"bank

money

creation"

using

this

example:

A

customer,

let's

call

him

Anton,

deposits

100

euros

in

cash

into

his

current

account

at

his

bank.

In

return,

he

receives

100

euros

credited

to

his

account.

The

bank

calls

this

balance

a

"sight

deposit".

Anton

can

now

access

these

100

euros

at

any

time,

either

by

making

a

cashless

transfer

or

by

withdrawing cash.

As

the

bank

is

clever,

it

doesn't

just

leave

this

deposited

100

euros

lying

around

and

wait

for

Anton

to

withdraw

some

of

it

at

some

point,

but

"works" with it.

If

Anton

now

wants

to

make

a

transfer

to

another

customer

of

the

same

bank,

let's

call

him

Bert,

the

bank

doesn't

even

have

to

touch

these

100

euros.

It

only

has

to

deduct

this

amount

from

Anton's

account

in

the

computer

and

add

it

to

Bert's

account.

Over

the

years,

the

bank

has

gained

a

certain

amount

of

experience

as

to

what

percentage

of

its

sight

deposits

is

required

as

a

cash

reserve

in

order

to

be

able

to

cope

with

the

ongoing

withdrawals

and

transfers

to

other

banks.

The

banks

call

this

the

"technical

minimum

reserve".

In

order

to

be

"allowed"

to

"work"

with

the

money,

the

bank

must

also

deposit

the

legally

prescribed

minimum

reserve

with the central bank.

All

in

all,

this

means

that

the

bank

has

to

hold

around 3% of its sight deposits in reserve.

It can therefore "work" with the remaining 97%.

Of

the

100

euros

that

Anton

has

paid

in,

she

will

therefore

only

keep

3

euros

as

a

reserve,

the

other

97

euros

are

labelled

by

the

bank

as

"surplus reserve".

Incidentally,

it

is

not

even

legally

clear

to

whom

this

so-called

surplus

reserve

belongs.

And

since

this

is

not

clearly

clarified

by

law,

the

bank

considers

it

legitimate

to

dispose

of

this

"surplus

reserve"

completely

freely,

of

course

without

informing Anton.

The

bank

may

now

grant

this

97

euros

to

a

borrower

as

a

loan,

or

it

may

act

as

if

this

97

euros were the minimum reserve for a new loan.

In

this

way,

she

now

grants

another

customer,

let's

call

him

Christian,

a

loan

totalling

3233.33

euros.

This

means

that

the

3%

reserve,

which

she

needs,

is

exactly

the

97

euros

"surplus

reserve"

from Anton's paid-in 100 euros.

The

bank's

balance

sheet

now

shows

a

liability

of

3233.33

euros

to

Christian,

who

now

wants

to

dispose of this money.

At

the

same

time,

however,

the

bank

now

has

a

receivable

of

EUR

3233.33

from

Christian,

as

he

has to repay the amount with compound interest.

On

the

assets

side,

as

well

as

on

the

liabilities

side,

the

bank's

balance

sheet

therefore

shows

an

amount

of

3233.33

euros,

which

can

be

described

as a transaction not recognised in profit or loss.

However,

the

bank

will

earn

interest

on

these

3233.33

euros

and,

in

the

event

that

Christian

is

unable

to

repay

his

loan,

the

bank

will

legally

take

away

Christian's

property,

which

he

has

deposited

as

collateral

for

the

loan.

This

is

despite

the

fact

that

the

bank

has

not

suffered

any

loss,

because

the

money

for

the

loan

was

not

even in the bank's possession.

So

what

happened?

The

bank

received

100

euros

in

cash

from

Anton

and

then

granted

3233.33

euros

as

a

loan

to

Christian,

purely

through

accounting

transactions.

In

this

way,

3133.33

euros

were

"created"

or

rather

"scooped

up"

that

were

not

there

before.

And

although

this

is

not

cash,

this

so-called

"bank

money"

is

just

as

usable

in real terms.

A

few

transactions

by

the

bank

have

now

created

money

that

Christian

has

to

pay

back

with

interest

without

the

bank

having

provided

anything in return.

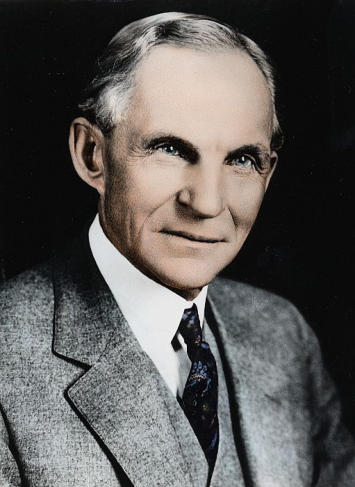

By the way, Henry Ford once said:

If people understood

the monetary system, we

would have a revolution,

before tomorrow morning!